Why are iPhone 5c cases, in all of their platonic perfection, covered with pencil marks?

My class on media archaeology has a regular assignment where students conduct a “product autopsy,” tearing down old (and hopefully inoperable) gadgets to understand their origins and supply chains. Mobile phones are a favorite example, both because of their intricacy and because few students have seen inside them. The assignment requires learning to recognize not only individual components (camera sensors; capacitors; wire assemblies), but the language of contemporary manufacture, discerning the meaning of circuit boards, barcodes, and part numbers. It is, I think, a popular assignment—but it is rarely a surprising one. While the devices we have dissected over the years have spanned a range of models and manufacturers, they tend to be similar, and filled with similar sorts of symbols.

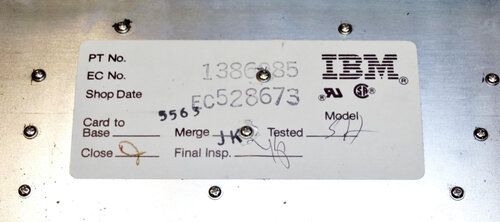

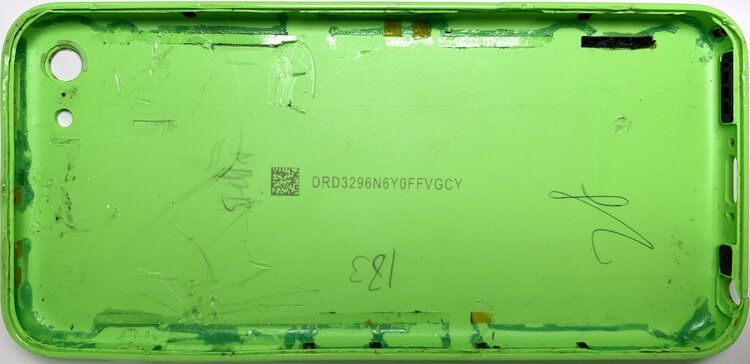

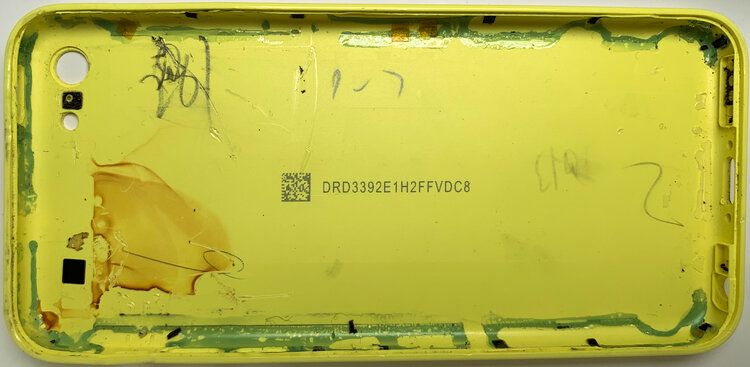

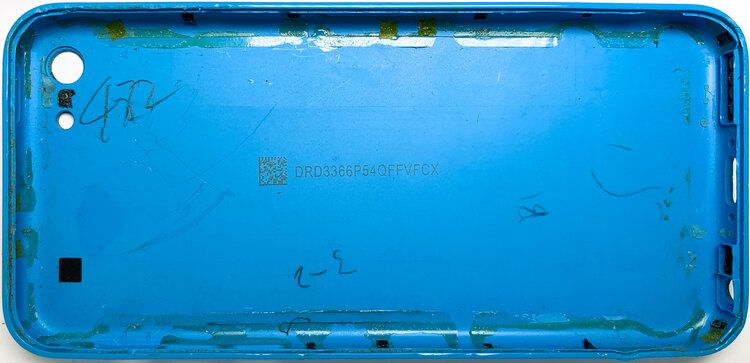

But when my students found what looked to be pencil markings on the interior of an iPhone 5c, we were surprised. Just what were these scribbles, and how did they get there? To answer these questions was not just to follow this broken object’s supply chain back to its moment of assembly, but also to understand what it meant for these marks to be made in the first place.

The history of a product is told by the marks of its making. Early commodities were made things, and they brought with them the literal hallmarks of manufacture. Stamps and seals encoded an originary identity connected to an individual craft hall and craftsperson, promising that an object had been “made in” Sheffield, for example, or Solingen. But beyond these obvious indications was the language of assembly itself: The unfinished sides, unraveled threads, and slips of hammer and chisel that until recently marked our manufacture. Heavily accented and regional, this was a kind of communication visible to all but comprehensible only to craftspeople. These were the human signs of production.

For casual consumers, an object’s story was confined to the inspection tickets and product tags attached at the end of its manufacture. Of these, only tags remain a familiar sight. But even when they are present—marking out something as “designed in California” or (perhaps grudgingly) “made in China”—they are often frustratingly general. There is nothing tying them to a particular object, after all, only to a particular product line. And while inspection tickets were once ubiquitous, they’re far less common now. Their initialed signatures may have identified their human inspectors only as no. 3 or 6, but they still assured us that each item on the assembly line had undergone some final, individual appraisal. Stuck to the backs of radios and slipped into the pockets of pants, these marks may have been of interest only to cranks and romantics. But the doctor and Poet John Stone’s Poem in Praise of Perfect Pants spoke of these inspection tickets as “a charm,” protecting its bearer:

against all future irregulars

which may have been inspected

and sent away

without love…

But what does it mean when even these messages are gone? If this fleeting charm has failed us, do we still retain the personal connection to production we might once have had?

Open up old electronics and you will find obvious evidence of the hands that made them: Blobs of unsightly solder, wires that jump in often unexpected directions. Their modern descendants reveal comparatively little of their inner life. Loosed from white cardboard packaging, their functional parts are covered with layers of protective presentation. Seeming no earthly thing (though surely it is the most rare of earth from which they are made), their polished appearance serves only to mask the signs and signals of production. They are perfect. Smooth and seamless, they have no chips, scuffs, or scratches. As inaccessible as the brands that branded them, it is impossible to imagine the realities of production outside an abstract assemblage of assembly. There are no fingerprints on these reflective surfaces. Other than in the rarest of circumstances, we see in them only the blank expressions of our own faces, amazed by the wonder of their construction.

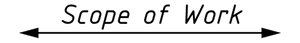

Despite this veneer, modern electronics are inscribed with a myriad of marks—just not, strictly speaking, human ones. While manufacturing methods like the bill of materials (the BOM) are familiar to contemporary makers, their complexity is a relatively recent development—one amplified by an increasing drive toward the patterns of outsourcing and subcontracting that constitute supply chain capitalism. When computerized management first came to the shop a half century ago, the limitations of memory were so severe that early bills of material could not be recorded as single data entities. The solution was to break them into component parts, such that each part or subassembly became an individual bill with an individual shop order. As the scale of these subassemblies grew, the shop was now relegated, in the words of Richard Lilly, to the “business of making parts instead of products.” The consequence was that these things were no longer purely human productions. Humans may (and do, more often than we think) produce modern parts, but they can no longer produce modern products.

The forms of communication that now mark these objects owes little to the history of tickets and tags. After all, reading them requires lasers rather than eyes, light sensors rather than optic nerves. A product like the iPhone, for example, is littered with nonhuman graffiti—components lined with electronic indications that attest to their assembly. Even the tiniest components now come printed with 2D barcodes. Most of these are used for process tracking and quality control purposes, though high-profile parts—like Apple’s A-series chips and the lithium-ion batteries that power them—often contain legal notices and logos. Intended either for corporations or computers, an iPhone’s internal inscriptions are an entirely nonhuman constitution—full of product codes, regulatory requirements, and business-to-business branding.

Imagine the surprise, then, when my students found pencil markings—with all of their humanity and romance and imperfection—on the interior of an otherwise unmarked iPhone 5c. Following a tedious application of heat gun and pliers to loosen the metal cage affixed to the iPhone’s back case, we found a strange and surprising sequence of numbers and letters. Some short (“B1”), some longer (“482”), and all at various angles and orientations. As marks, they were meaningless. But the marking, itself, surely had meaning.

IPhone 5c, A1532

The iPhone 5c was released in September of 2013 alongside its upmarket counterpart, the iPhone 5s. A great deal of speculation had surrounded the introduction of this new “low-cost” iPhone, and so had a great many questions. Chief among these was what, exactly, the “C” stood for. The “S” that had appeared alongside the name of every mid-cycle revision since the 3GS had, after all, a similarly murky meaning. The first release had stood for “speed.” For the next, commentators suggested that it might represent the introduction of the Siri voice assistant. With the seventh-generation iPhone, the only significance was that Apple wouldn’t confirm one. As a consequence, an entirely new letter lent itself to seemingly intentional ambiguity.

Perhaps, some suggested, it stood for “color.” Unlike prior models, the 5c came in colors beyond the familiar black, white, and metal. These new hues included blue, green, yellow, and white, along with a pink that the company called “coral.” But while color is itself a kind of marking, the only indication of this chromatic differentiation was an internal barcode (hidden inside the iPhone’s shell) and an electronic encoding in the device’s boot ROM. A colorblind consumer would not have been able to tell the phone’s color by looking at its model number, which differentiates only by compatible carrier. If the “c” in “5c” was a meaningful mark, it must have meant something else. Some argued that it might fit the market rather than the markings—”consumer,” perhaps, or “cost.” Others suggested a less flattering appellation, but while this phone was less expensive than Apple’s other offerings, one would be hard-pressed to describe it as “cheap.”

Indeed, Apple’s chief designer, Jony Ive, called the 5c a “distillation” of what people loved about the iPhone 5, just one that was “beautifully, unapologetically, plastic.” Hewn from “a single piece of polycarbonate” and fixed to a steel reinforced frame, the materials of the case constituted a kind of “bespoke assembly.” This was reflected in the fact that—unusual for a phone with a plastic case—holes for the buttons and rear plate were machined rather than molded. Undergoing multiple finishing processes, with a clear lacquer hard coat providing a final polish, the result was tough—three times stronger than the PET film used to scratchproof the display. But it was also lightweight. Just a little under 60 mm wide, 124.55 mm tall, and 8.98 mm deep, the case weighed 14.2 grams—a tenth of the phone’s total. Still, even with disappointing sales (reported to be only 24 million), this amounted to 340 metric tons of plastic resin over the life of the product.

Despite the attention this case received in Apple’s own marketing, critical analysis of their supply chain tended to focus on internal components like batteries and microchips—as if the object’s most visible parts were somehow too obvious to study. We are expected to think, often rightly, that it is the inaccessible innards that are worthy of inquiry. But all manner of sins may be hidden in the mundanity of the visible. There is nothing remarkable about a leather case for a phone, or a leather strap for a watch. But its appearance on a customer’s wrist nevertheless signals a shift in the supply chain—moving a company which indirectly deals in death to one which must, necessarily, manage a slaughterhouse.

As a company, Apple is notoriously reticent to allow any imperfections to appear on its products, or to offer any marks that might reveal their making. It would prefer consumers believe this polycarbonate slab arrived in Cupertino from a place not unlike the Carrara quarries, where, as it was with Michelangelo’s David, the form of the phone was waiting within. But the supply chain of the iPhone is not—at least not entirely—a secret. After all, Apple has (since 2011) published a yearly accounting of the suppliers of its products. But this list is neither complete (it represents only the “top” percentage), nor differentiated, nor does it offer an explanation as to the role of the often unfamiliar and variegated enterprises it contains. One company may play many parts, and rarely is there an answer as to individual responsibility for a piece. For example, while Apple discloses a number of plastics suppliers (companies like Coxon Precise Industrial, Nan Ya Plastics, and Nishoku Technology), what any of these firms provide, let alone what they provide for a specific product, is not specified. Nan Ya Plastics specializes in synthetic rubber—which might suggest the 5c's rubber case. But they are also a supplier of a "protective shell material polycarbonate," in whole or in part. Nishoku, on the other hand, has been linked to "casing" production at its factory in Kunshan, but it is unclear which casing this might be. Even then, it is reasonable (even likely) to assume that these components are shared across a number of product lines.

The fact is that the “supply chain” hardly resembles the ordered linking its name evokes. This is an interwoven and bifurcated business. It would be unthinkable for Apple, with one of the most popular products of the past decade, to depend on a single assembler or intermediary for any part (though there are crucial chokepoints, in final assembly for example, or in the cellular modems responsible for Apple’s dispute with Qualcomm). At the deepest depths of the chain, questions of provenance become matters of probability, a piece of polycarbonate suspended in quantum construction. Even in the immediate upstream, it would be difficult to definitively identify the company responsible for delivering a component like our case.

This suggests that we might struggle to say where, exactly, our part had been unexpectedly penciled. But perhaps not. Given its flashy and fleeting appearance in the company’s product matrix, an analysis of the 5c may offer a unique opportunity to narrow down the particulars of Apple’s sprawling supply chain. While the company continues to experiment with “low-cost” iPhones (the new iPhone SE the latest example of this effort), at the time of release the plastic shell of the iPhone 5c set it apart from the rest of Apple’s assemblies. Apple has used, and indeed continues to use, polycarbonate—notably in products like AirPods. But in 2013, news of an entirely plastic iPhone was novel enough to bring widespread industry attention and excitement. It reflected Apple’s response to rising competition in the high-end mobile market. Plastics like ABS and polycarbonate allowed manufacturers to cut expenses without sacrificing “design flexibility” by enabling lightweight, visually attractive products that were cheaper to manufacture. If we ever wanted to know what the production pathway for the case of an iPhone would look like, Apple’s “unapologetic” move into plastics offers an ideal opening.

100,000 Workers

In the minds of many, the first stop on the iPhone 5c supply chain (outside the Apple Store cabinets where employees pull its packages) must be Foxconn, its Zhengzhou manufacturing plant and the 120,000 workers gathered there. But while Foxconn (Hon Hai Precision Industry Co., Ltd.) has received significant attention for its role in iPhone production, it was competitor Pegatron (Heshuo United Technology Co., Ltd.) that was responsible for filling most (nearly two-thirds) of the iPhone 5c’s orders. Foxconn and Pegatron are two of the largest electronics manufacturing service companies, the sorts of firms responsible for the final assembly of an iPhone. For our supply chain investigation they would seem a reasonable starting point. And, as a China Labor Watch leak reported in the months leading up to release, there are a lot of details to be found in this last step on the line:

The task on my assembly line is to assemble back covers. The assembling of other parts of the cell phone, including the final assembly into a finished product, is assigned to different production facilities, each facility partitioned off by heavy curtains so that workers in different departments are isolated from one other. Today’s work is to paste protective film on the iPhone’s plastic back cover to prevent it from being scratched on assembly lines. This iPhone model with a plastic cover will soon be released on the market by Apple. The task is pretty easy, and I was able to work independently after a five-minute instruction from a veteran employee. It took around a minute to paste protective film on one rear cover. The new cell phone has not yet been put into mass production, so quantity is not as important. This makes our job more slow paced than in departments that have begun mass production schedules.

Supply chain investigations have taken on new urgency as we have moved to confront the fragile state of global supply. But they remain messy and meandering. This is not logistics, after all, but the reverse. Here, we follow the probabilities of production not to an end, but to one of thousands of possible beginnings. In this Labor Watch report we find a starting point, an assumption that it is Pegatron—and the 100,000 workers employed at its Shanghai campus at the end of 2013—that can fulfill our inscriptive inquiry. If so, then it is here where our case, filled with its precious sensors, batteries, and mysterious marks, will finally be closed. To find where it opened, we must begin with the raw materials that will come to constitute our colorful enclosure—and before they have yet taken form.

Lexan EXL1414 Resin

Polycarbonate is a thermoplastic polymer that is both strong and easily worked. It is produced through the reaction of bisphenol A, an organic synthetic compound made from acetone and phenol (commonly abbreviated BPA), and phosgene, a poisonous gas gathered by passing purified carbon monoxide and chlorine gas through activated carbon. It was discovered, by chance, at Du Pont in 1928, but significant industrial manufacture of the material did not begin until the early 1960s. Polycarbonate has become popular in a wide range of manufacture over the past several decades, with particular resins marketed under a wide variety of brand names. These include Makrolon, Tecanat, Acetron, Luran, Retain, Lustran, and, of course, Lexan.

SABIC is the world’s fourth-largest chemical producer. Given the extensive nature of its portfolio, what, exactly, the Saudi Arabian Basic Industries Corporation might do for a company like Apple is something of an open question. But in 2013 it was Apple’s use of SABIC Innovation Plastics as a polymer supplier that received industry attention. SABIC’s large supply of polycarbonate resin, and the color capabilities they were noted for, would have been a fit regardless of whether the “c” stood for cost or color. Indeed, insiders reported that Apple required them to carefully customize colors to the firm’s exacting specifications, developing unique color numbers not just for the 5c’s novel “coral,” but even for its seemingly nondescript “white.” As far as our investigation goes, we know that SABIC operated three suppliers in 2013: in the United States, in Shanghai, and in Guangzhou. But what resin, which supplier, and what location a case’s polycarbonate came from is not something we can determine with any degree of certainty. What little we do know comes not from SABIC or Apple, but from frequent imitator, Xiaomi.

Like the company it is often accused of copying, Xiaomi decided that it too would go “beautifully, unapologetically plastic” for its 2013 catalogue. Launching several months before the 5c, Xiaomi’s Mi2A phone shared not only the colorful look of the iPhone, but a common supplier. As SABIC describes it, the Lexan EXL1414 Xiaomi used for the back case “is a medium flow opaque injection-molding grade material.” With rich color options, impact resistance, and low temperature ductility, it enables shorter injection molding cycles when compared to standard polycarbonate resins. And while we can’t say for certain that this is the exact material designation and supplier site for Apple’s case, it would make sense for them to have made a similar choice.

But if one end of the supply chain rests at Pegatron’s Shanghai facilities, and the other at SABIC’s Shanghai supplier, what of the lines and nodes between them? We know from the Labor Watch report that the cases assembled by Pegatron come with metal and polycarbonate already attached. For our marks to have been made, they would need to be written at some point between the plastic’s production and the case’s final assembly. So what are the processes and preparations that this resin must undergo, and (more importantly) where are the sites responsible for them? Given the rippling structures of supply, it is never easy to answer these questions. But here—in this one particular case—we may just be lucky enough to say for sure.

After all, while the iPhone 5c may have been officially unveiled at Apple’s September “special event,” this wasn’t the first time enthusiasts had been able to glimpse its candy colors. Though unreported at the time, a warehouse employee had made off with copies of the case, and unauthorized videos detailing the design had appeared all over web forums and social media. Suppliers like Catcher, Zeniya, Amphenol, Murata, Laird, Lateral, Lite-On, Molex, and Pioneer all had molding capabilities that could have been used for the 5c, as did Foxconn itself. But there was only one who was responsible for this secondary trace. Of course, with a characteristic lack of transparency, the source of the leak—and consequently, the case—was not (at that time) clear.

32 seconds/case

Jabil Circuit Inc. is an American manufacturing service company headquartered in St. Petersburg, Florida. Founded in 1966, it employed over 180,000 workers in 90 factories at the time of the 5c’s manufacture—one of whom was responsible for the leak of the 5c’s plastic case. But even if we never had confirmation that Jabil was the source of this leak, there would have been plenty of reasons to suspect their involvement in some part of the case’s production. With machinery allowing them to mass produce high-end plastic and metal moldings for handset OEMs like Nokia, Motorola, and Blackberry, they were not only one of the world’s largest contract manufacturers of electronics, but a world-scale injection molding company with over 755 injection machines operated by their Green Point unit in 2010. And if leaked cases and industry speculation were not evidence enough, a second China Labor Watch investigation later confirmed that it was Jabil’s factory in Wuxi that was responsible for producing “the rear plastic covers of Apple’s so-called cheap iPhone.”

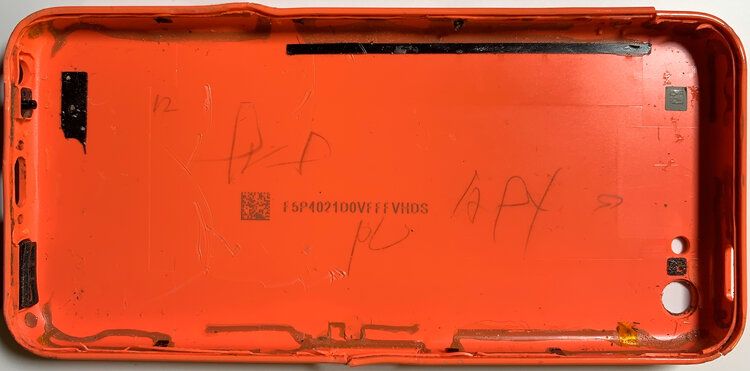

Jabil Green Point's Wuxi facility. Jabil's website describes it as "the first Jabil Lean Mode factory" with "1,6000,000 [sic] sq. ft." of manufacturing space and "a strong focus on 'People and Process.'" They also indicate a physical location about 8 km away from its true address.

At the time of the investigation, Jabil managed eight factory buildings and more than 30,000 workers at their Green Point Wuxi facility. The report alleged a number of abuses, noting that more than 80% of workers interviewed reported hours exceeding Apple’s 60/week standard, with some as high as 100. Salaries could be as low as 1,500 Chinese yuan (~$245) per month (including unpaid overtime). The report admonished that “Apple products are manufactured at the expense of Chinese workers, laboring in factories owned by Taiwanese, Hong Kong, and, in the case of Jabil, US-owned companies.” Jabil disputed the allegations, arguing their focus on “continuous auditing – by internal, independent third-parties and customers” was generally able to identify issues and improve compliance. But they conceded that they were not always perfect. “We are disheartened that there are allegations that we are not living up to our own standards.”

For our purposes the interesting part of this investigation is that it had unexpectedly confirmed that it was the Wuxi factory which had—for several years—been responsible for making the “finely polished” “molding” on the back of iPhones, as well as the “metal band” and “metal shelf” used to secure their internal components. In many ways, this undercover exposé was a rare insight into factory operations at one of Apple’s less well-known suppliers. And while they were not the last stop on the supply chain—Jabil’s output would be delivered to Foxconn or Pegatron for the final low margin assembly work—they were a critical connection along the way. With departments organized around the work of shaping (injection molding), polishing, washing, laser etching, spraying, laser welding, and machining the case, as well as attaching the adhesive my students would later struggle to remove, these operations represent a critical stage in the production history of one quite particular piece.

This is all to say that it was here, in Jabil’s Wuxi factory, where plastic and metal were fashioned and fused, where the steel reinforced frame was affixed to the polycarbonate case that would comprise the iPhone 5c’s “bespoke assembly.” It was not hewn from a slab, but from a factory laboring to make it resemble one. Working with forms fresh from the molding machines, workers placed them in an apparatus that polished out any marks left from the process of production. It takes approximately 32 seconds to process a case, and supervisors mandate only 10 seconds between them. The result seems smooth. Perfect. But some marks are more easily missed. This is where the signs scrawled in our case were first made, then forgotten.

B1, 482, 3-2

The precise meaning of the messages my students found scrawled in their iPhone 5c is something only workers or managers at the Wuxi factory could definitively determine. But they are probably not quite so mysterious. We could reasonably assume they are batch numbers, inspection indications—signals of accounting and oversight made at various stages of the case’s manufacture. Here they were hastily penciled in the few seconds between the various stages of production, before being stuck under the grip of an industrial adhesive. If it was a charm, it was a secret one.

This was no solitary sign. Indeed, similar markings can be found on most (though not all) of the iPhone 5c’s I’ve inspected. One might wonder if the otherwise unmarked cases represent a different pathway of production, a different supply chain with a different supplier. That, too, is hard to say. What can be said is that the message itself—regardless of whatever point or purchase it may have had at its place of production—meant something to my students. That stamped on the surface of these lifeless things were human marks made by human hands. To the rest of us it may mean something else. If the history of a production is told by the marks of its making, what is left when we can no longer read—or even see—these mysterious marks?